Build your future - one click at a time

Understanding your risk appetite

Understanding your risk appetite

| Potential for Capital Growth | Expected Volatility | Expected potential returns | Investment objective | |

|---|---|---|---|---|

| Risk Averse | Low | Low | Low | Focused on portfolio preservation / stability with some income generation |

| Conservative | Low – Medium | Low – Medium | Low – Medium | Focused on a modest level of portfolio appreciation with minimal risk or volatility |

| Balanced | Medium | Medium | Medium – High | Focused on a balance between portfolio stability and appreciation, willing to take some risk to generate higher returns and capital growth |

| Aggressive | High | High | High | Strongly focused on generating high returns and willing to accept large fluctuations in your portfolio performance, willing to take high risks including a leverage on your assets to improve your potential capital growth |

Understanding the difference between SIP and Lumpsum investments

Why SIP (Systematic Investment Plan)?

- Get disciplined: Make investments periodically to achieve your dreams

- Start small, think big: You can start investing as low as Rs. 100 only every month but still benefit from compounding

- Tough to time: Timing the market is very difficult, with SIPs you don’t have to!

- Skip the Stress: Skip investing in any month or quarter if funds are tight

- Add on when you want: It is easy to start another SIP if you have more funds

Get disciplined: Make investments periodically to achieve your dreams

Start small, think big: You can start investing as low as Rs. 100 only every month but still benefit from compounding

Tough to time: Timing the market is very difficult, with SIPs you don’t have to!

Skip the Stress: Skip investing in any month or quarter if funds are tight

Add on when you want: It is easy to start another SIP if you have more funds

Why Lumpsum (one-time significant cash outflow)?

Why Lumpsum (one-time significant cash outflow)?

One-time cash outflow you would make at your own discretion

Allows you to buy more units at lower prices during market lows, allowing you to potentially generate higher returns.

A good option for you if you have some knowledge about market cycles!

Look out for market information

- Keep an eye on information across products to help you make an informed decision

Investment within minutes

- Seamlessly invest in more than XX mutual funds from more than XX leading AMCs via SIP or lumpsum investment

- Use your existing bank account or open a new one with ICICI

- Invest in equities, bonds, fixed deposits, and customised PMS with ICICI Direct

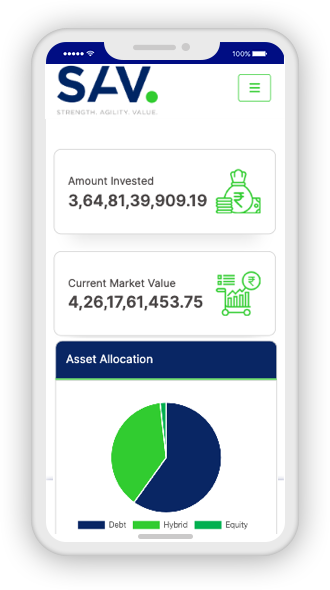

Review your portfolio

- Access comprehensive reports on your portfolio to gauge your performance including P&L, XIRR and more!

1

Look out for market information

Keep an eye on information across products to help you make an informed decision

2

Investment within minutes

- Seamlessly invest in more than XX mutual funds from more than XX

leading AMCs via SIP or lumpsum investment

- Use your existing bank account or open a new one with ICICI

- Invest in equities, bonds, fixed deposits, and customised PMS with ICICI Direct

3

Access comprehensive reports on your portfolio to gauge your performance including P&L, XIRR and more!