PLAN YOUR INVESTMENTS

Build your future - one click at a time

Select your goal below and assess how much money you would need to invest to fulfil your goal!

calculate your deposit

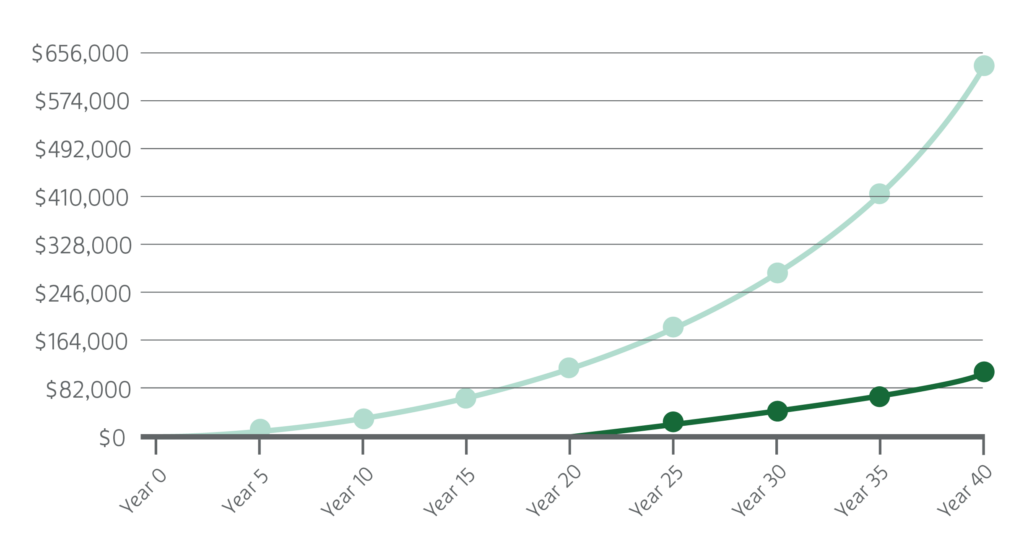

CHECK HOW YOUR INVESTMENTS CAN GROW OVER TIME GIVEN DIFFERENT POTENTIAL RETURNS

| Potential for Capital Growth | Expected Volatility | Expected potential returns | Investment objective | |

|---|---|---|---|---|

| Risk Averse | Low | Low | Low | Focused on portfolio preservation / stability with some income generation |

| Conservative | Low – Medium | Low – Medium | Low – Medium | Focused on a modest level of portfolio appreciation with minimal risk or volatility |

| Balanced | Medium | Medium | Medium – High | Focused on a balance between portfolio stability and appreciation, willing to take some risk to generate higher returns and capital growth |

| Aggressive | High | High | High | Strongly focused on generating high returns and willing to accept large fluctuations in your portfolio performance, willing to take high risks including a leverage on your assets to improve your potential capital growth |

Get disciplined: Make investments periodically to achieve your dreams

Start small, think big: You can start investing as low as Rs. 100 only every month but still benefit from compounding

Tough to time: Timing the market is very difficult, with SIPs you don’t have to!

Skip the Stress: Skip investing in any month or quarter if funds are tight

Add on when you want: It is easy to start another SIP if you have more funds

1

Invest within minutes

Seamlessly invest in more than XX mutual funds for more than XX leading AMCs via SIP or lumpsum investment

– Use your existing bank account or open a new one with ICICI

Invest in equities, bonds, fixed deposits and customised PMS with ICICI Direct

2

Use market information to invest

Look out for research and information on your investment products to help you make an informed decision

3

Review your portfolio

Access comprehensive reports on your portfolio to gauge your performance including P&L, XIRR and more!